.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

A New-Age Cloud-Native SaaS-based API ready Platform for Accident & Health Insurers!

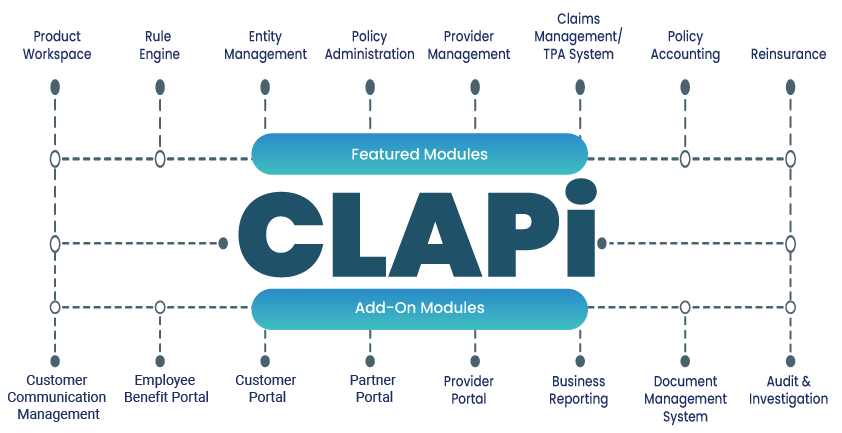

Bridging the gap between an API management layer and Insurance systems and serve the needs of Insurance providers, customers, and other third-parties. Introducing CLAPi©– a hyper modular, SaaS based cloud-native platform, having hundreds of APIs pre-built for automation, which is not only built for back-office automation, but also brings a simplified approach in transforming hardcoded business logic from system of records to middle office. The platform is built on New Age technologies like containers, microservices, serverless functions and immutable infrastructure, deployed via declarative code.

Tap in to our Modules portfolio for tangible results that deliver impact because complex challenges require smarter solutions!

Product Workspace

Our easy to navigate interface helps the user to configure the product instantly. CLAPi® provides a single product workspace for Accident & Health Insurance to configure product definition and rules for multiple Lines of Businesses – Retail, Group, Travel and Event Based.

Rule Engine

Highly configurable yet the most user-friendly Rule Engine that allows users to create complex rules in the simplest manner. Over 100 pre-configured Algorithms to manage and support Accident & Health Insurance Pre-Policy Issuance (such as auto underwriting, member profiling and Post Policy issuance such as auto claim adjudication, claim scoring and Suspicious claim alerts).

Entity Management

An API enabled interface with functionalities to perform de-dupe and world check for both individual or corporate entities during the profile creation process. The interface follows a multifunctionality approach and allows individual entity and bulk entity creation with an inbuilt functionality of personal profiling using IOT Data.

Policy Administration

A cloud-native API ready, highly Scalable and integrated System, designed to cater to Accident & Health, Retail and Group Policies with various premium calculation methods. The system provides a 360-degree view of the proposal on the underwriting workbench to the underwriter, thereby helping in an accurate decision-making process.

Provider Management

A comprehensive and integrated interface that manages complete provider empanelment lifecycle and empowers providers to manage and update their profile, services and tariffs in the most secure and simplest manner.

Claims Management/TPA System

A rule-based interface that automates claim adjudication and claims life-cycle to manage both in-network and out of network claims for Accident & Health, improving efficiency and customer satisfaction. The interface can be easily integrated using APIs with internal and external system platforms and communicate on a real-time basis.

Policy Accounting

A cloud-native API ready platform which caters to PAS-related financial transactions in real-time. The module provides the option to define statement of accounts in a simplified manner. This module can be easily integrated with any external core accounting system using offline and real time methods.

Reinsurance

A comprehensive risk evaluation and management tool that automates and manages complex reinsurance allocations/contracts based on facultative and non-facultative, proportional and non-proportional treaties with multiple ceding criteria.

Please fill in the required fields to personalize the right experience for you.

Please fill in the required fields to personalize the right experience for you.

Please fill in the required fields to personalize the right experience for you.